Гроші за реєстрацію з виводом на карту 18 сайтів, які платять

31 octobre 2025E ma attraente la opzione di selezionare le slot per jackpot

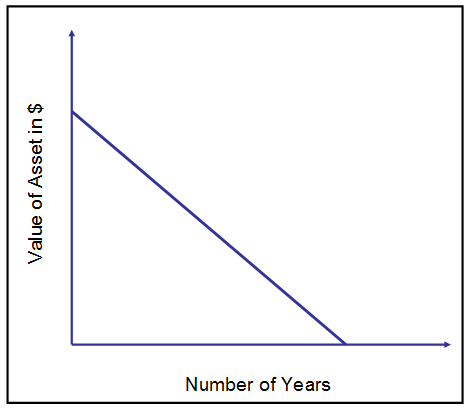

31 octobre 2025This method aids in correct monetary reporting and likewise helps businesses plan for future investments and bills. The declining stability technique of depreciation does not recognize depreciation expense evenly over the lifetime of the asset. Somewhat, it takes into consideration that assets are typically extra productive the newer they are and turn into much less productive in their later years. Because of this, the declining steadiness depreciation technique data higher depreciation expense to begin with years and less depreciation in later years.

The exception to the above is if the asset is first placed in service at another time than at the beginning of the year. If that is the case, then the primary year’s depreciation expense is prorated based mostly on what share of the yr the asset was in service. Then, the rest of the first 12 months’s partial depreciation expense is assigned to the ultimate yr of the assets helpful life — as shown within the instance beneath. Plus, the calculator additionally calculates first and last yr depreciation expenses in cases the place the asset is placed in service for a partial first 12 months. This calculator will calculate an asset’s depreciation expense based on its acquisition price, salvage worth, and expected helpful life.

Tickmark, Inc. and its associates do not present legal, tax or accounting recommendation. The information supplied on this web site doesn’t, and isn’t meant to, constitute legal, tax or accounting recommendation or recommendations. All data prepared on this site is for informational functions solely, and should not be relied on for legal, tax or accounting advice. You ought to consult your own authorized, tax or accounting advisors earlier than engaging in any transaction. The content material on this website is offered “as is;” no representations are made that the content material is error-free. Save time with automated accounting—ideal for people and small businesses.

Depreciation Method Utilized

It is most probably to be used when tracking machine hours on a machine that has a finite and quantifiable number of machine hours. The depreciation expense calculated by the straight line depreciation technique could, subsequently, be higher or less than the units of output technique in any given year. Right Here is how to calculate the annual depreciation expense using double declining stability. The estimated interval over which an asset is expected to be used, often identified as its useful life, is significant in calculating straight-line depreciation. It dictates how the asset’s value spreads over time, and changes to the helpful life can significantly have an effect on depreciation expenses.

Nevertheless, for property that lose value shortly or have uneven utilization, different methods could additionally be more suitable. At the top of each year, review your depreciation calculations and asset values. Modify for any sudden adjustments, like reduced useful life due to heavy utilization or market shifts affecting salvage worth.

The double-declining balance technique is a form of accelerated depreciation. It means that the asset shall be depreciated sooner than with the straight line method. The double-declining steadiness technique leads to greater depreciation expenses to start with of an asset’s life and lower depreciation expenses later. This method is used with property that quickly lose worth early in their helpful life. A company may also select to go with this method if it provides them tax or money circulate advantages. The income statement exhibits all income and expenses which were generated and incurred in the given accounting interval.

- This technique is especially appropriate for assets that experience constant wear and tear over time, benefiting from evenly spread-out expense recognition.

- This offers you the depreciable amount, which you divide by the asset’s helpful life.

- Capital expenditures are the prices incurred to repair assets and purchase assets.

- Understanding the financial well being of a business entails plenty of accounting.

- This method additionally accelerates depreciation but makes use of a fraction primarily based on the asset’s remaining life.

The full amount for all 5 years, $4,500, is known as the depreciable price and represents the whole depreciation expense for the asset over its helpful life. The main objective is to guarantee correct monetary reporting and preserve compliance with tax legal guidelines. Monitoring asset depreciation is a core a part of managing your fastened property and getting ready accurate monetary stories. Whether it’s office tools, factory machinery, or firm automobiles, most long-term belongings lose worth over time. Once determined, divide the total depreciation expense by the coinciding useful life assumption to arrive on the annual depreciation expense, which will be periodically acknowledged on the earnings statement.

The firm can now expense $1,000 annually to account for the tools’s declining worth. This $1,000 goes into accumulated depreciation till $500 remains as the tools’s value. Now that you have calculated the purchase price, life span, and salvage worth, it is time to subtract these figures.

What Depreciation Is, What The Straight Line Method Is, And Tips On How To Calculate It

Using the $10,000 machine example, just because you aren’t writing a $1,000 verify for the machine’s depreciation on an annual basis, does not mean you might have an extra $1,000 to spend. It implies that you need to be setting $1,000 aside annually so you’ll find a way to exchange the machine on the finish of its useful life — without dipping into your working capital. In my 30-plus years of being a small enterprise owner, I truly have seen lots of small enterprise start-ups fail simply because the small enterprise homeowners had no formal information of accrual-based accounting. In turn, this caused the owners to mistake excess cash as being spendable profit. Calculate straight line depreciation for the first, last, and interim years of an asset’s helpful life.

It simplifies allocating the cost of property over their helpful life, ensuring predictable and consistent monetary reporting. Lastly, the straight-line method enhances transparency in your financial reporting. In such cases https://www.simple-accounting.org/, an alternative depreciation system (e.g., units-of-production depreciation technique, accelerated depreciation method) may better characterize the pattern of an asset’s economic use.

The equipment has an anticipated life of 10 years and a salvage value of $500. Accelerated depreciation acknowledges a better loss of worth within the earlier years of an asset’s lifespan, reflecting quicker wear-and-tear or obsolescence upfront. This method can be useful for companies trying to maximize deductions sooner.